Are You Overpaying for payment processing? Find Out Now!

In today’s competitive business landscape, every penny counts. While you’re focused on delivering exceptional products or services and attracting new customers, it’s easy to overlook a crucial expense that can significantly impact your bottom line: payment processing.

Many businesses are unwittingly overpaying for their payment processing services, often due to complex fee structures, outdated equipment, or simply not shopping around for the best rates. It’s time to take a closer look at your current setup and determine if you’re leaving money on the table.

The Hidden Costs of payment processing

Understanding the intricate web of fees associated with accepting credit and debit card payments is paramount. These fees aren’t always transparent and can vary significantly depending on several factors. Here’s a breakdown of the key elements contributing to the overall cost:

-

Interchange Fees: These are the fees charged by card-issuing banks (like Visa or Mastercard) and make up the largest portion of your payment processing costs. They vary based on the type of card used (e.g., credit, debit, reward cards), transaction method (e.g., swiped, keyed-in, online), and merchant category code (MCC). Higher risk industries or transactions involving premium cards typically incur higher interchange fees.

-

Assessments: These are fees charged by the card networks (Visa, Mastercard, Discover, American Express) to cover their operating costs and brand marketing. Similar to interchange fees, assessments also fluctuate based on transaction type, volume, and other factors.

-

Processor Markup: This is the fee charged by your payment processor, often expressed as a percentage plus a per-transaction fee (e.g., 2.9% + $0.30). This markup is where processors make their profit, and it’s crucial to compare rates across different providers. Some processors offer flat-rate pricing, while others use tiered pricing or interchange-plus pricing. Understanding the differences is essential for making an informed decision.

-

Monthly Fees: Some processors charge monthly account maintenance fees, minimum processing fees, PCI compliance fees, or statement fees. These seemingly small charges can add up quickly and should be carefully considered when evaluating different options.

-

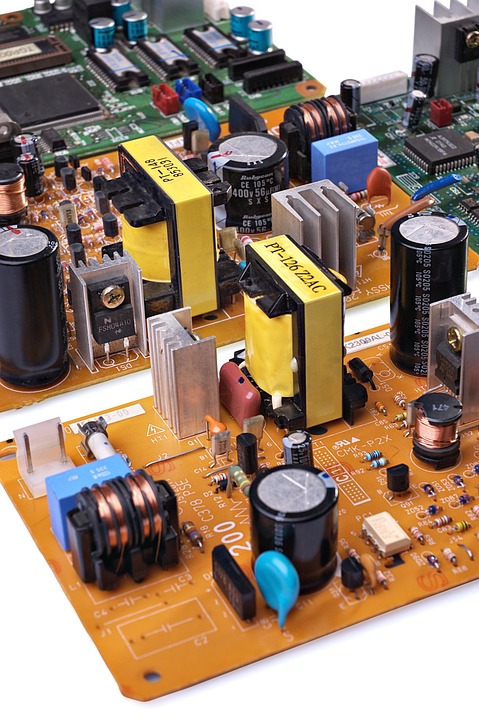

Equipment Costs: Whether you’re using physical point-of-sale (POS) terminals, online payment gateways, or mobile payment solutions, there are often associated equipment costs. This can include upfront purchase costs, monthly rental fees, or software subscription fees. For example, if you are using Authorize.Net as your payment gateway, you need to factor in their monthly gateway fee.

-

Other Fees: Be aware of potential hidden fees such as early termination fees, chargeback fees, or address verification service (AVS) fees. Read your contract carefully to understand all the potential charges.

Signs You Might Be Overpaying

If you experience any of the following, it’s a strong indication that you could be overpaying for payment processing:

-

Lack of Transparency: If your processor doesn’t provide clear and detailed statements, making it difficult to understand the fees you’re being charged, it’s a red flag.

-

High Monthly Minimums: If you’re consistently failing to meet your monthly minimum processing volume, you’re essentially paying for services you’re not using.

-

Outdated Equipment: Using outdated POS terminals or software can result in higher processing fees and increased security risks.

-

Complex Fee Structures: Tiered pricing models can be confusing and often lead to higher costs, as transactions are categorized into different “tiers” with varying rates.

-

Sudden Fee Increases: Unexpected or unexplained increases in your processing fees should be investigated immediately.

-

Poor Customer Support: If you struggle to get timely and helpful support from your processor, it might be time to switch to a provider that prioritizes customer service.

How to Lower Your payment processing Costs

Here are some actionable steps you can take to reduce your payment processing expenses:

-

Shop Around and Compare Quotes: Don’t settle for the first processor you find. Obtain quotes from multiple providers and carefully compare their rates, fees, and terms.

-

Negotiate with Your Current Processor: Once you have competitive quotes, use them as leverage to negotiate better rates with your existing processor. They may be willing to lower their fees to retain your business.

-

Understand Your Pricing Model: Familiarize yourself with the different pricing models (flat-rate, tiered, interchange-plus) and choose the one that best suits your business needs. Interchange-plus pricing is generally considered the most transparent and cost-effective option.

-

Optimize Your Transaction Methods: Encourage customers to use lower-cost transaction methods, such as swiping cards instead of keying them in. Implement address verification services (AVS) to reduce the risk of fraudulent transactions.

-

Stay PCI Compliant: Maintain PCI compliance to avoid costly penalties and protect your business and customers from security breaches.

-

Review Your Statements Regularly: Scrutinize your payment processing statements each month to identify any discrepancies or unexpected charges.

-

Consider Cash Discount Programs: Offer a discount to customers who pay with cash, encouraging them to avoid using credit cards and reducing your processing fees.

FAQs

Q: What is PCI Compliance, and why is it important?

A: PCI DSS (Payment Card Industry Data Security Standard) is a set of security standards designed to protect cardholder data. Compliance is crucial for protecting your business from data breaches and avoiding penalties from card networks.

Q: What is the difference between a payment gateway and a payment processor?

A: A payment gateway securely transmits transaction data between your website or POS system and your payment processor. A payment processor handles the actual transfer of funds between the customer’s bank and your merchant account.

Q: How often should I review my payment processing fees?

A: You should review your statements monthly and periodically (at least annually) compare your rates to those offered by other processors.

Q: Are all payment processors created equal?

A: No. Pricing, customer service, technology, and security measures can vary greatly between different processors. It’s important to do your research and choose a provider that meets your specific needs.

Conclusion

Overpaying for payment processing is a common problem that can significantly impact your business’s profitability. By understanding the various fees involved, recognizing the signs of overpayment, and taking proactive steps to lower your costs, you can free up valuable resources to invest in other areas of your business. Don’t let excessive processing fees drain your profits.

If you’re unsure where to start or need expert guidance in navigating the complex world of payment processing, contact Payminate.com today. We can analyze your current setup, provide competitive quotes, and help you find the best solution for your business needs. Let us help you unlock the savings you deserve and optimize your payment processing strategy.