Navigating the Labyrinth: Strategies for Successful High-Risk payment processing

In the ever-evolving landscape of e-commerce, certain businesses find themselves categorized as “high-risk.” This label, often unfairly assigned, can present significant challenges, particularly when it comes to payment processing. But what exactly constitutes a high-risk business, and how can these businesses navigate the complex world of payment gateways, chargebacks, and compliance to achieve sustainable success?

High-risk businesses are typically identified based on a variety of factors, including the industry they operate in, the potential for chargebacks, historical instances of fraud, and regulatory scrutiny. Common industries falling under this umbrella include online gaming, nutraceuticals, debt collection agencies, travel agencies, adult entertainment, cryptocurrency businesses, and even certain subscription-based models. While this classification can feel like a disadvantage, understanding the challenges and implementing strategic solutions is key to thriving in the high-risk market.

Understanding the Challenges:

The primary hurdle for high-risk businesses lies in securing and maintaining a stable merchant account. Traditional payment processors often shy away from these industries due to the perceived increased risk. This hesitancy stems from several factors:

- Higher Chargeback Rates: High-risk industries often experience higher chargeback rates due to customer dissatisfaction, buyer’s remorse, or fraudulent activity. Chargebacks are costly for both the merchant and the processor, leading to increased scrutiny.

- Increased Regulatory Compliance: Many high-risk industries are subject to stricter regulations and compliance requirements, making monitoring and enforcement more complex.

- Potential for Fraud: High-risk industries can be attractive targets for fraudulent transactions, requiring robust fraud prevention measures.

- Reputational Risk: Some processors may be concerned about associating their brand with certain industries, even if those industries are legal and legitimate.

Strategies for Success:

Overcoming these challenges requires a multi-faceted approach that prioritizes transparency, risk mitigation, and strategic partnerships. Here are key strategies for successful high-risk payment processing:

-

Choose the Right Payment Processor: Not all payment processors are created equal. Specifically, many processors that you might find that are mainstream processors may not allow you to sign up with them if you are a high-risk business. Opt for a payment processor specializing in high-risk industries. These processors understand the nuances of your business, are equipped to handle higher chargeback volumes, and have established relationships with acquiring banks willing to work with high-risk merchants. Research different processors, compare fees, and ensure they offer the features and support you need. Consider leveraging resources like https://paymentcloudinc.com/ for finding suitable high-risk payment processing solutions.

-

Implement Robust Fraud Prevention Measures: Investing in advanced fraud detection and prevention tools is crucial. This includes address verification systems (AVS), card verification value (CVV) verification, geolocation tracking, device fingerprinting, and transaction velocity monitoring. Consider using 3D Secure authentication for added security. Stay up-to-date on the latest fraud trends and adapt your strategies accordingly.

-

Maintain Transparent and Honest Business Practices: Transparency is paramount. Clearly communicate your terms and conditions, refund policies, and shipping information to customers. Provide excellent customer service and promptly address any concerns or complaints. Avoid misleading marketing practices and ensure your products and services are accurately represented.

-

Develop a Comprehensive Chargeback Management Strategy: A proactive chargeback management strategy is essential. This includes implementing clear communication channels with customers to resolve disputes before they escalate to chargebacks. Actively monitor chargeback rates and investigate the underlying causes. Gather compelling evidence to challenge illegitimate chargebacks.

-

Focus on Customer Retention: Acquiring new customers can be expensive, especially in high-risk industries. Focus on building strong customer relationships and fostering loyalty. Offer excellent customer service, personalized experiences, and valuable incentives to encourage repeat purchases.

-

Ensure PCI DSS Compliance: Regardless of your industry, adhering to Payment Card Industry Data Security Standard (PCI DSS) compliance is crucial. This involves implementing security measures to protect cardholder data, including encrypting sensitive information, regularly updating security systems, and restricting access to cardholder data.

-

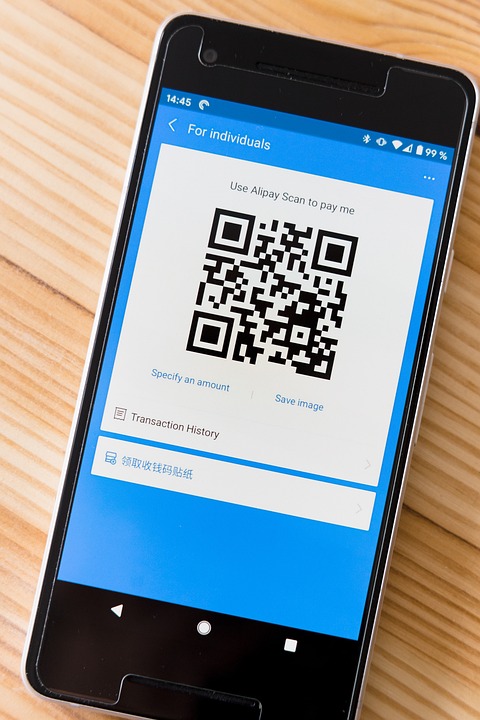

Diversify Payment Options: Offering a variety of payment options can cater to a wider range of customers and reduce reliance on credit cards, which are often associated with higher chargeback rates. Consider integrating alternative payment methods such as digital wallets, bank transfers, and cryptocurrencies. Using a payment gateway, such as Authorize.net, can help you offer different payment options.

-

Build Strong Relationships with Your Bank and Processor: Maintain open communication with your bank and payment processor. Understand their policies and requirements and promptly address any concerns they may have. Building trust and demonstrating a commitment to responsible business practices can help maintain a positive relationship.

FAQs:

-

What is a rolling reserve? A rolling reserve is a percentage of your sales that your payment processor holds back for a period of time (typically 3-6 months) to cover potential chargebacks or refunds. This is a common practice for high-risk businesses.

-

How can I lower my chargeback rate? By implementing robust fraud prevention measures, providing excellent customer service, and having a clear refund policy in place.

-

Are high-risk merchant account fees higher? Yes, high-risk merchant accounts typically have higher fees than traditional merchant accounts due to the increased risk involved.

-

How long does it take to get approved for a high-risk merchant account? The approval process can take longer than traditional merchant accounts, typically ranging from a few days to several weeks, depending on the processor and the complexity of your business.

Conclusion:

Navigating the world of high-risk payment processing can be challenging, but with the right strategies and partnerships, it is possible to achieve sustainable success. By understanding the risks, implementing robust fraud prevention measures, focusing on customer satisfaction, and choosing the right payment processor, high-risk businesses can overcome these hurdles and thrive in their respective industries.

If you are a high-risk business struggling to find reliable and affordable payment processing solutions, we highly recommend contacting Payminate.com. Their team of experts specializes in providing tailored payment solutions for high-risk industries, helping you navigate the complexities of payment processing and achieve your business goals. Their expertise will make the difference between a successful business and one that struggles to make sales.